Lex Scalper $29 + VQFX Scalper $39 = $68

Lex Scalper

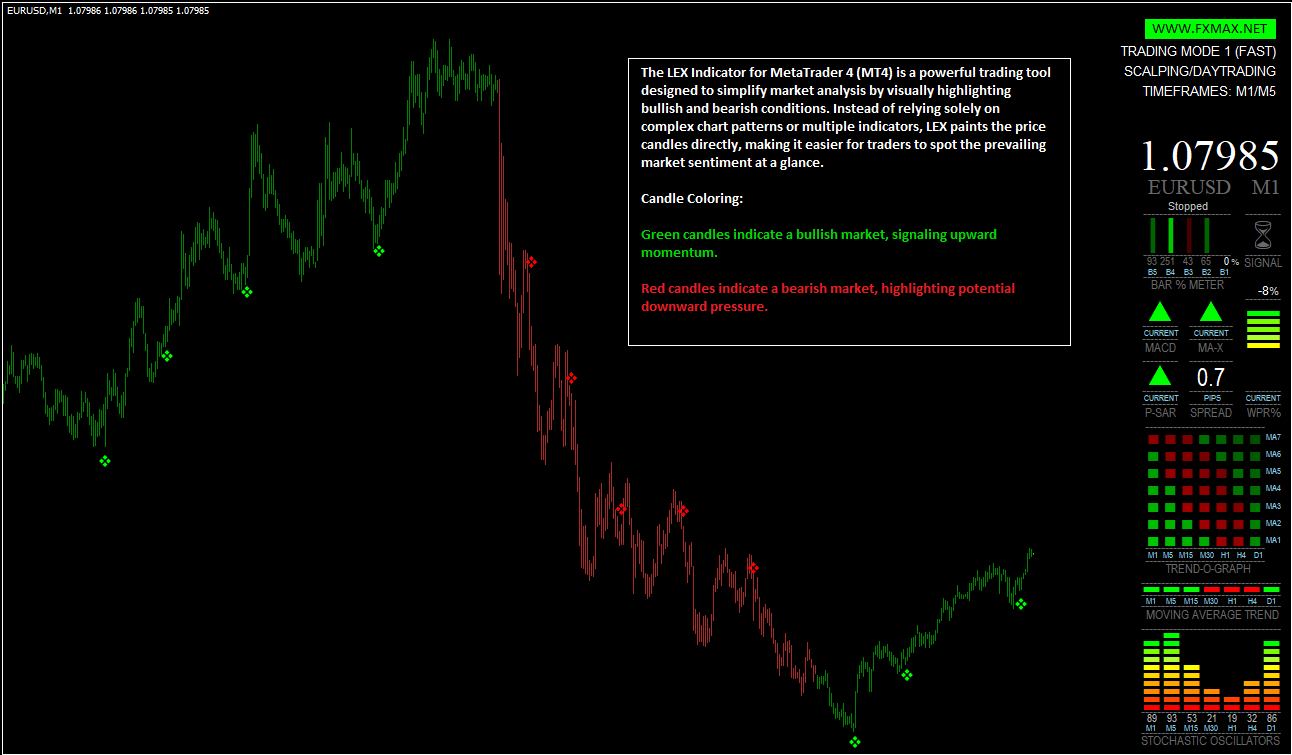

Understanding the LEX Indicator on MT4

The LEX Indicator is a custom tool for MetaTrader 4 (MT4) that helps traders identify market direction and potential entry points more clearly. It does this by painting candles on the chart in different colors, depending on whether the market is showing bullish or bearish momentum.

How It Works

Green candles: These appear when the indicator detects bullish conditions, suggesting that buying pressure is stronger and the price may continue upward.

Red candles: These appear during bearish conditions, signaling stronger selling pressure and a possible continuation to the downside.

By changing candle colors, LEX gives traders a quick visual cue about the current market sentiment without needing to interpret multiple indicators.

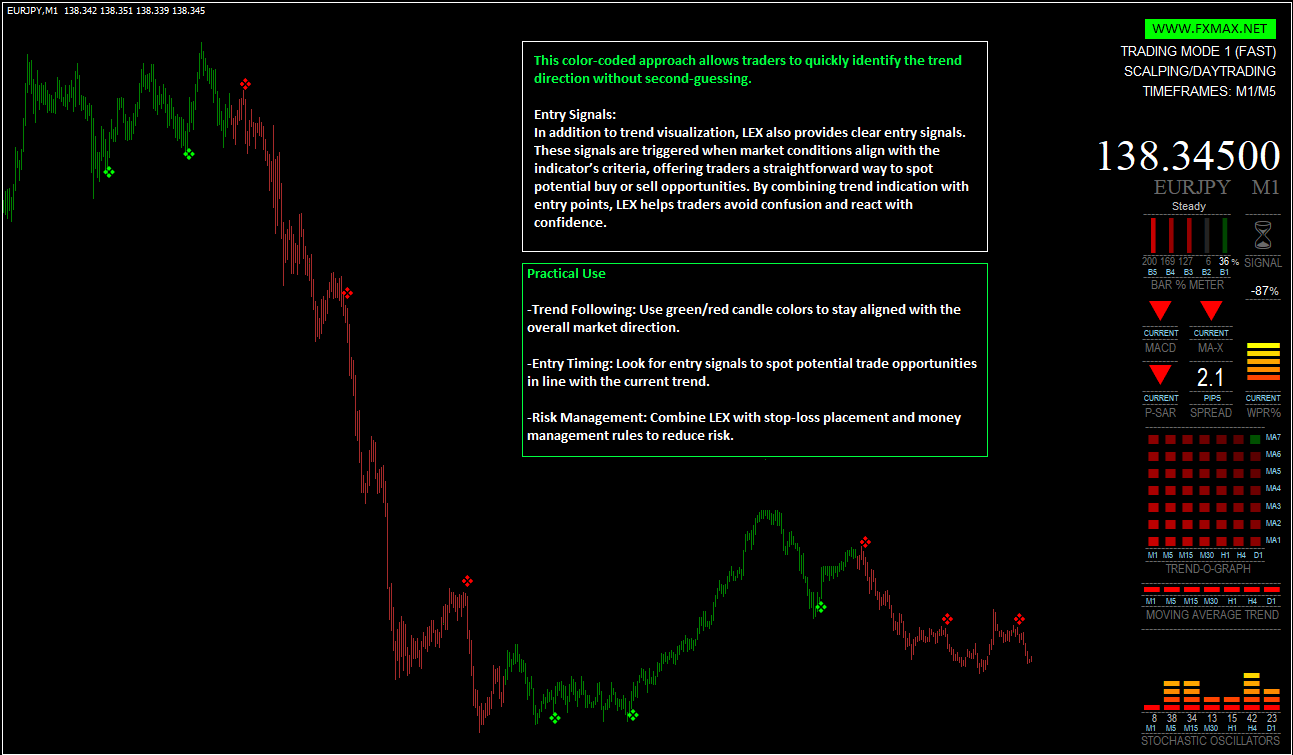

Entry Signals

Beyond coloring candles, LEX also generates entry signals. These signals are shown when specific conditions are met, such as a strong bullish reversal or a bearish continuation pattern. Traders can use these signals as guidance for potential buy or sell entries. However, like with any indicator, it is best to confirm these signals with additional analysis (support/resistance levels, trendlines, or higher-timeframe trends).

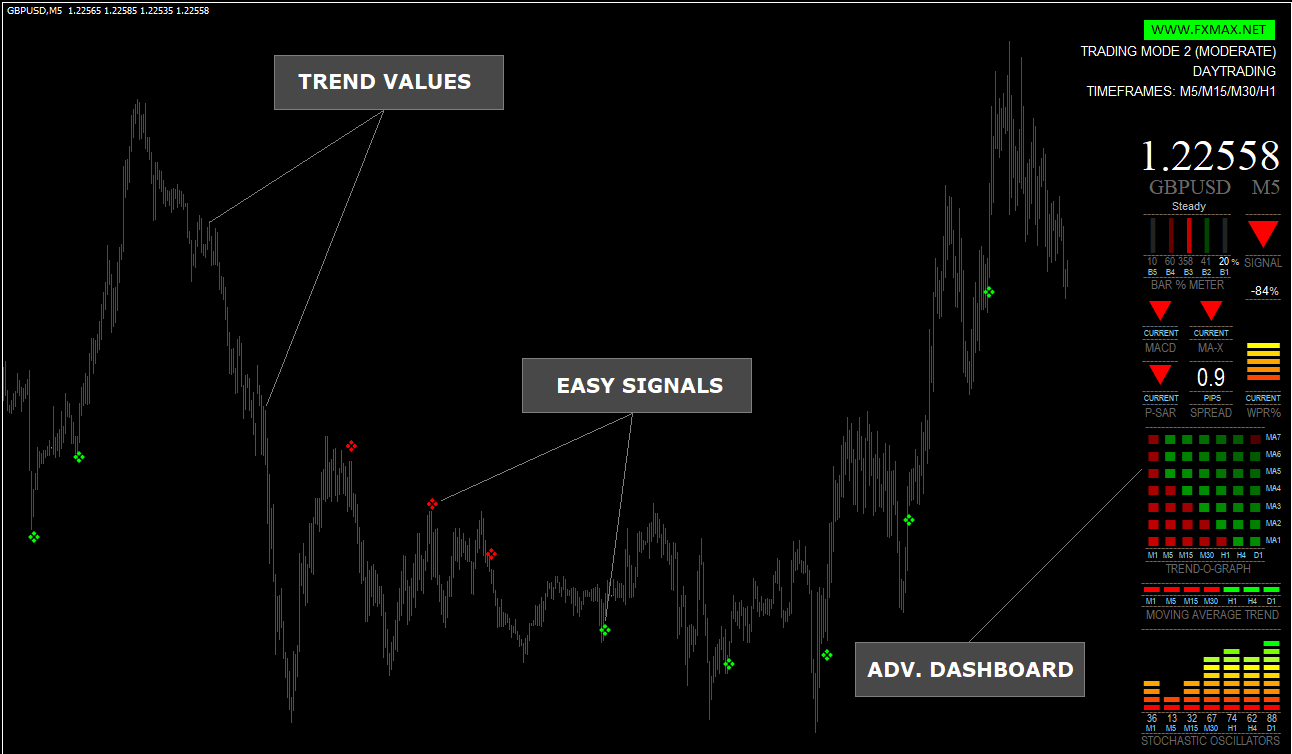

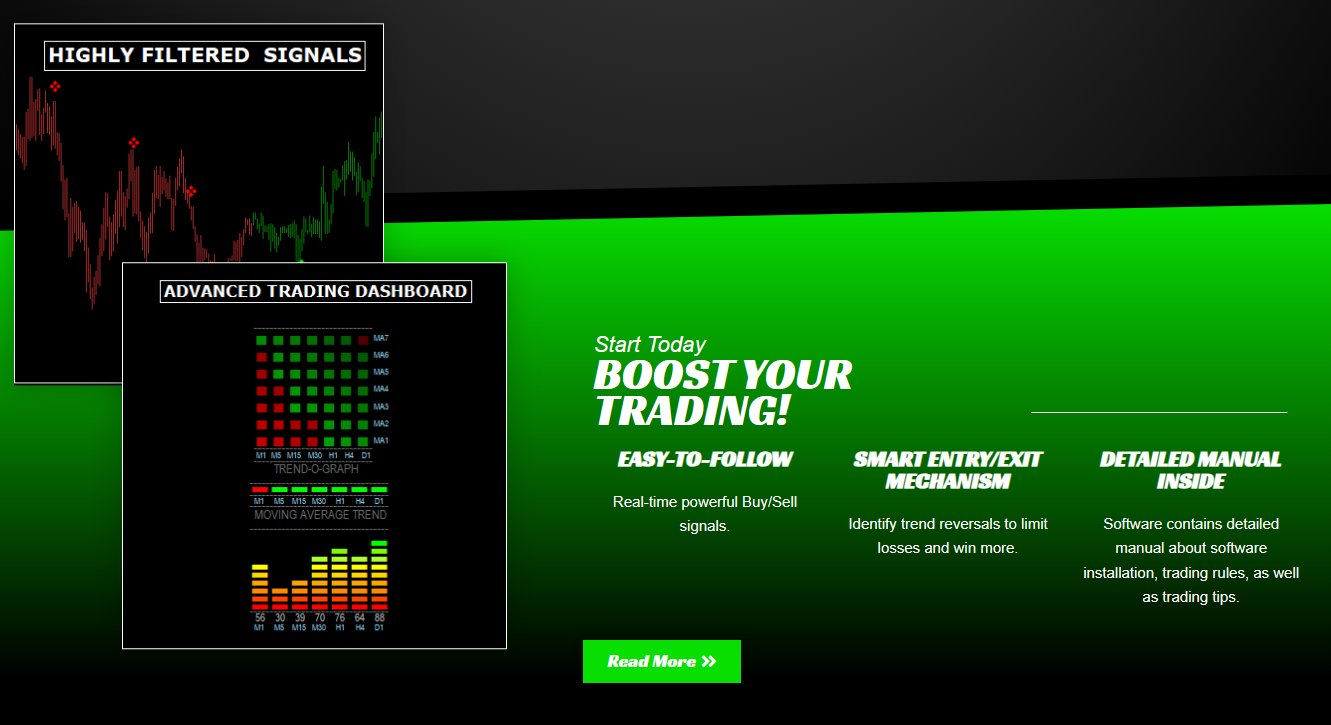

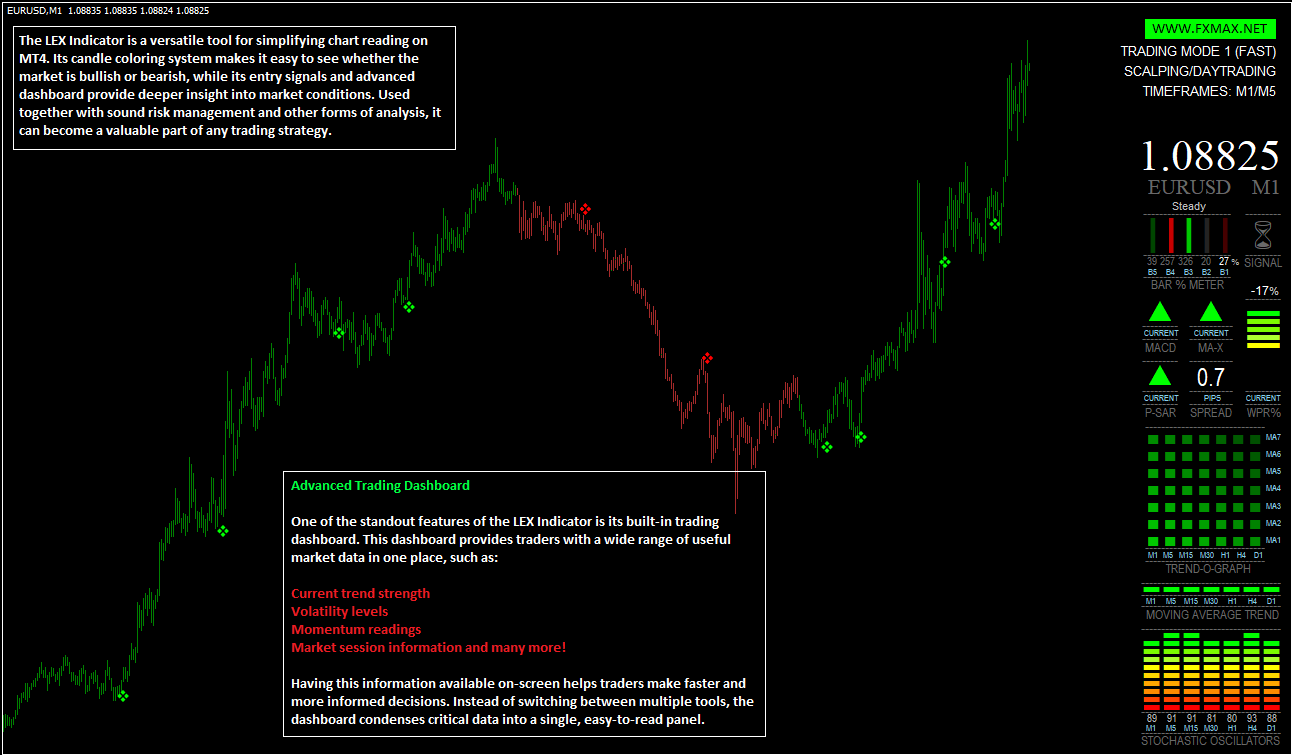

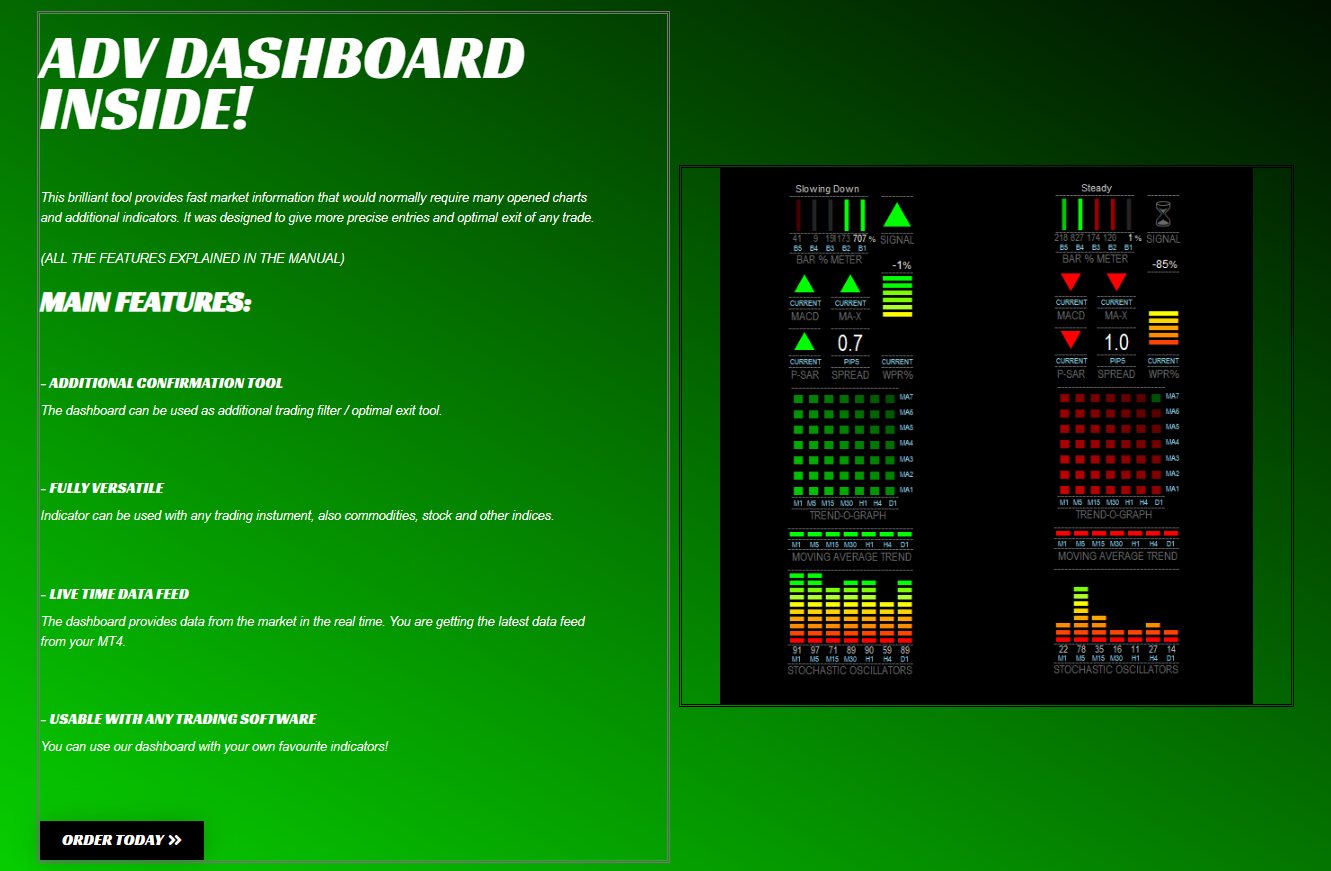

Advanced Trading Dashboard

One of the standout features of the LEX Indicator is its built-in trading dashboard. This dashboard provides traders with a wide range of useful market data in one place, such as:

Current trend strength

Volatility levels

Momentum readings

Market session information and many more!

Having this information available on-screen helps traders make faster and more informed decisions. Instead of switching between multiple tools, the dashboard condenses critical data into a single, easy-to-read panel.

VQFX Scalper

VQFX – Advanced Scalping Technique

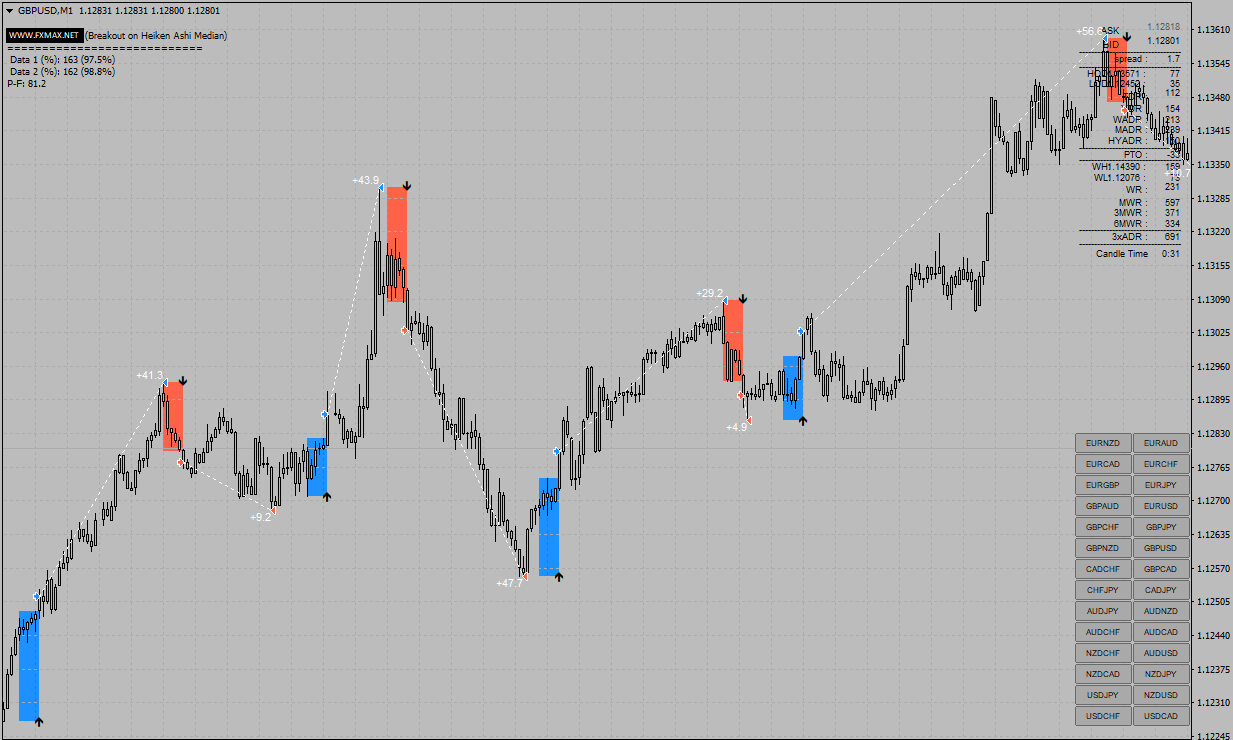

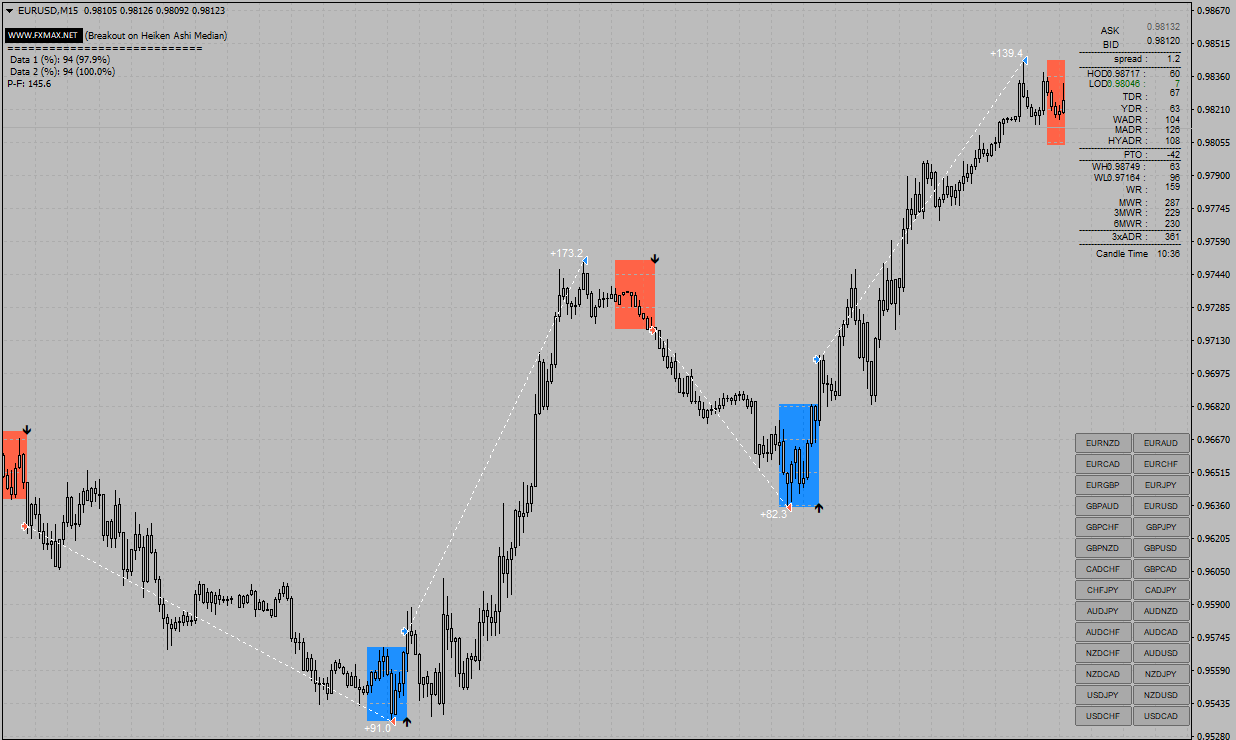

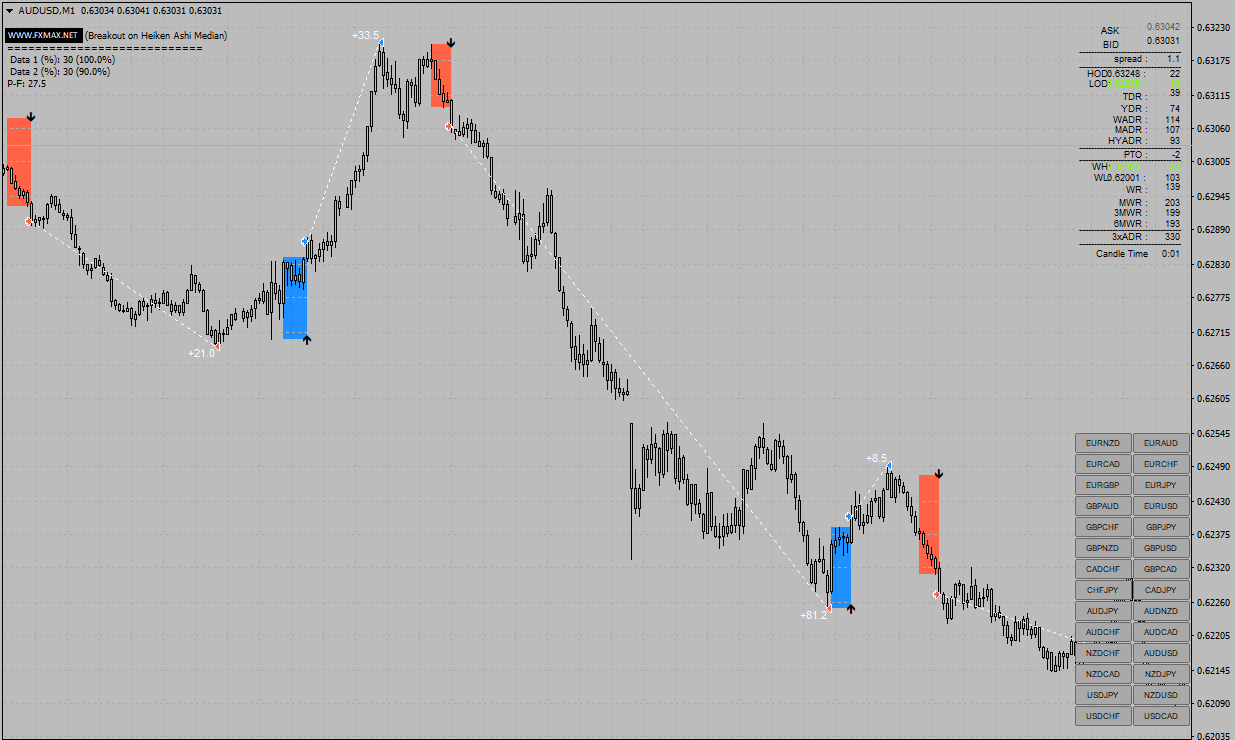

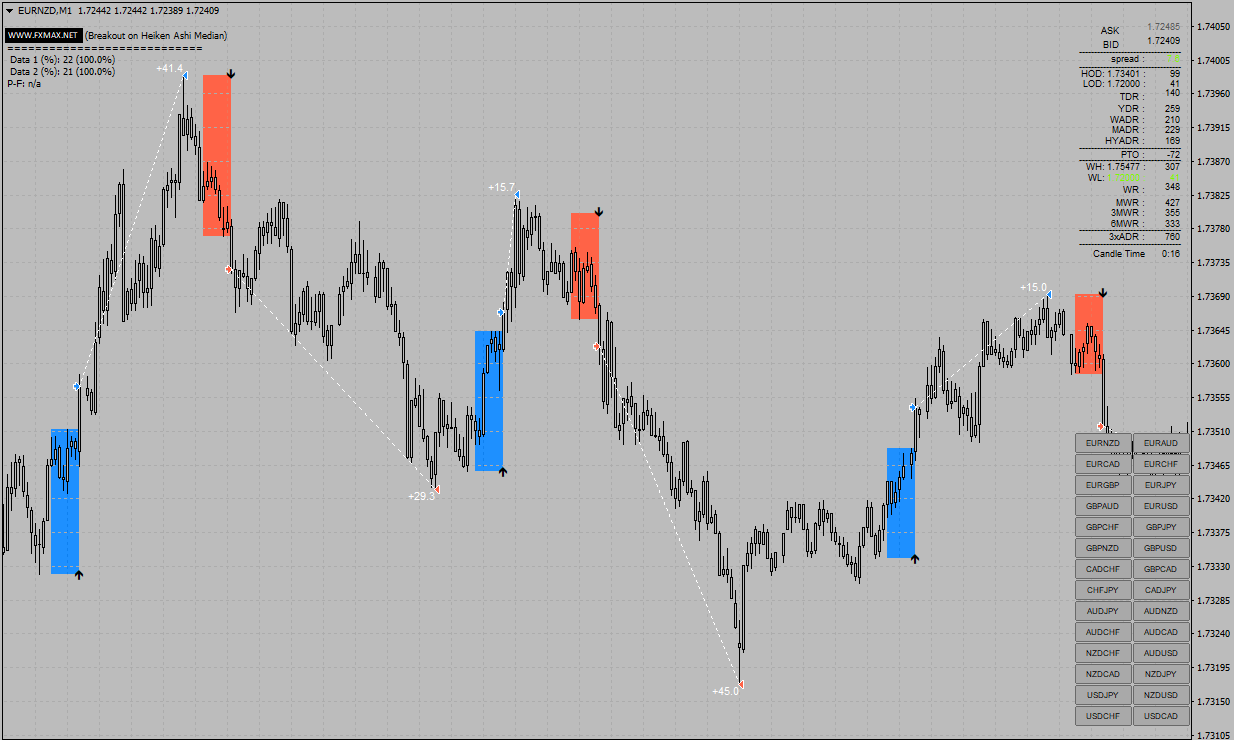

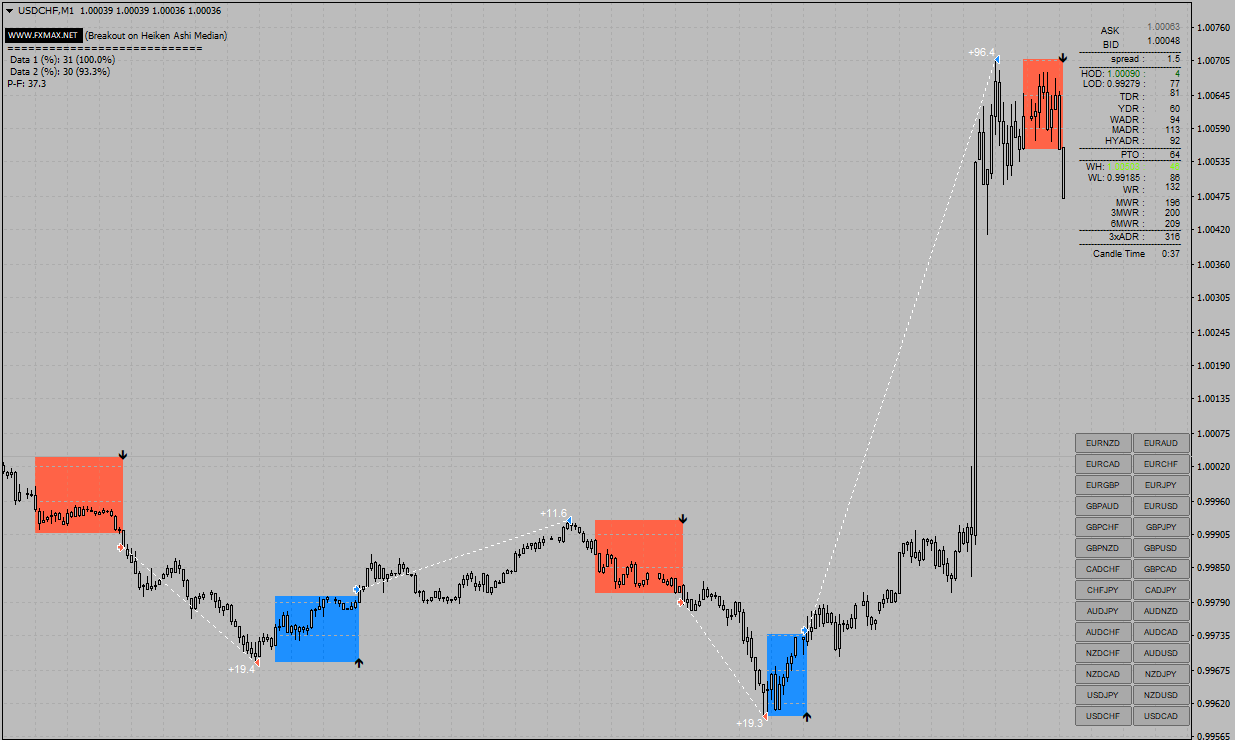

The VQFX Indicator for MetaTrader 4 is a volatility- and trend-based tool designed primarily for scalping and short-term intraday trading. Its core function is to identify potential tops and bottoms by analyzing shifts in volatility and directional pressure, helping traders anticipate reversals and continuation phases with reduced lag.

How It Works

Volatility-Adjusted Signals: VQFX continuously adapts its calculations to the current volatility of the market. This allows it to remain responsive in fast conditions while filtering out insignificant price fluctuations in quieter periods.

Trend Confirmation: The indicator plots directional bias by highlighting bullish and bearish phases, often aligning with micro-trends. This makes it useful not only for scalping but also for confirming entries during intraday swing setups.

Top and Bottom Detection: By monitoring exhaustion points in volatility, the tool highlights likely reversal zones. These can be used as potential entry points for countertrend scalps or for tightening stops in trend-following trades.

Applications

Scalping: On lower timeframes (M1–M5), traders can use VQFX to time entries around short bursts of momentum or exhaustion points.

Day Trading: On higher intraday charts (M5–H1), it can be applied to refine entries, manage stops, or confirm breakout/pullback conditions.

Confluence Tool: VQFX can be used also combined with structure analysis (support/resistance, supply/demand) or volume/volatility filters to validate its signals.

Settings & Customization

Sensitivity Adjustment: The main parameter allows the trader to fine-tune how reactive the indicator is. Lower sensitivity captures major swings only, while higher sensitivity picks up minor intraday fluctuations.

Visual Cues: The indicator typically plots color-coded signals (e.g., arrows or bands) to mark potential reversals and directional shifts for ease of interpretation.