Core ACC – Accumulation Technique

- Estimated Delivery : Instant Download

- Updates Included: Yes

CORE ACC Indicator – Technical Overview

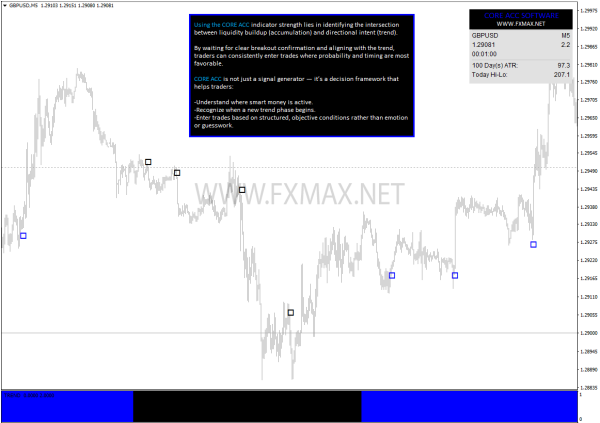

CORE ACC is an MT4 custom indicator that provides trade entry signals based on accumulation zone detection and trend calculation. The indicator is designed to help traders identify potential market turning points and continuation phases by analyzing price behavior and volume distribution over time.

1. Purpose

The CORE ACC indicator combines accumulation analysis and trend structure detection to identify optimal entry points in alignment with the dominant market direction. It assists traders in recognizing zones where institutional participants are likely accumulating or distributing positions before a directional move.

2. Core Logic

The indicator operates based on two main analytical components:

a. Accumulation Zones

-

The algorithm detects periods of low volatility and horizontal price movement that indicate accumulation or distribution phases.

-

These zones are calculated using price range compression, candle structure, and relative volume activity.

-

Once the price breaks out of an accumulation zone with momentum, a potential entry signal is generated.

b. Trend Calculation

-

CORE ACC includes an internal trend engine that calculates the current directional bias of the market.

-

The trend is determined using smoothed moving averages, directional momentum, and price structure validation.

-

Trend confirmation ensures that signals are aligned with higher probability market direction, reducing false entries.

3. Signal Generation

An entry signal is triggered when both conditions are met:

-

Price exits an accumulation zone with valid breakout criteria.

-

The calculated trend direction confirms the breakout direction.

-

Buy signals occur when an accumulation breakout aligns with an uptrend.

-

Sell signals occur when an accumulation breakout aligns with a downtrend.

Each signal is displayed directly on the chart using visual markers.

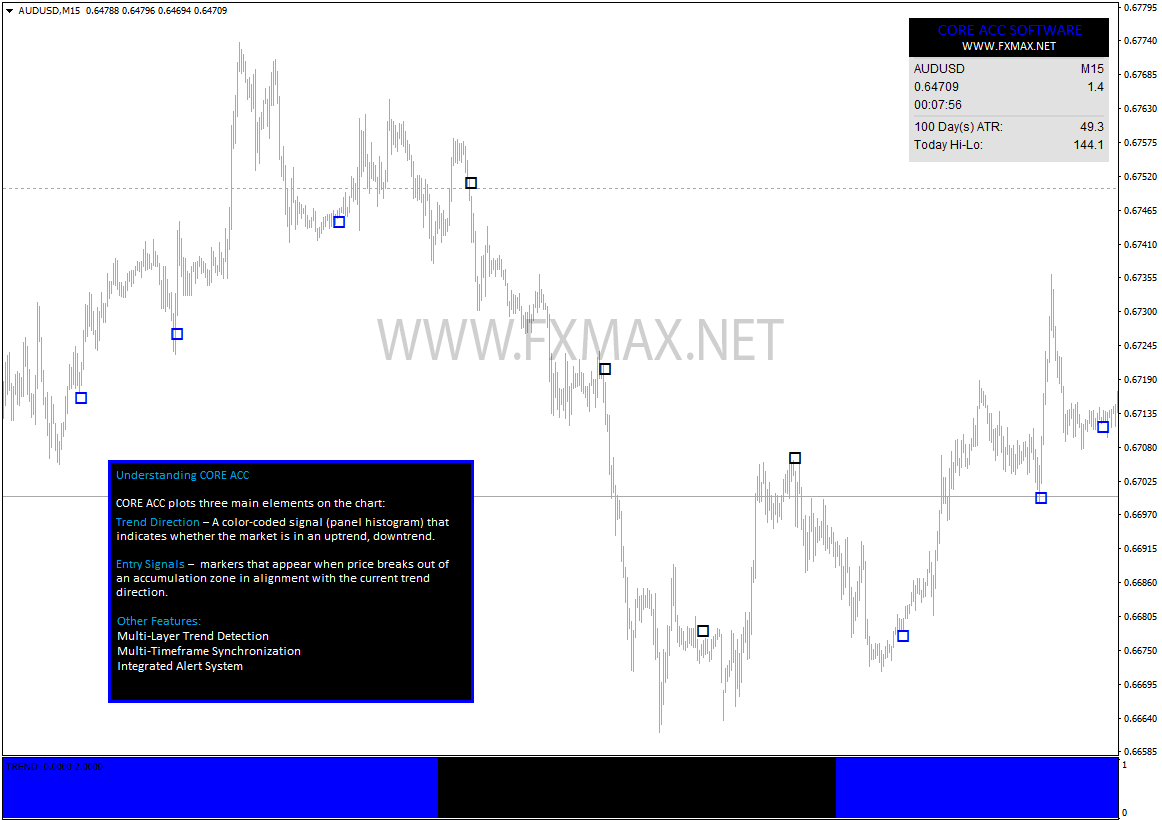

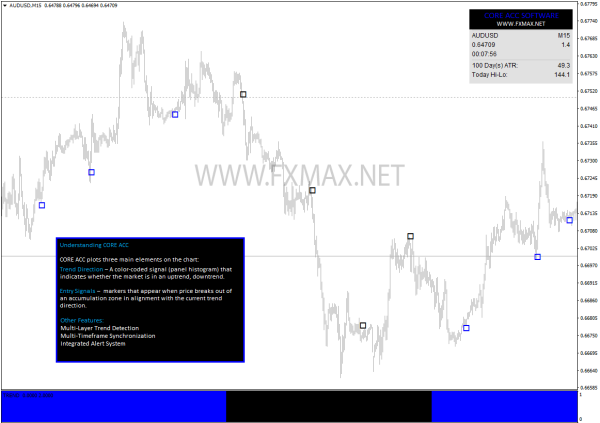

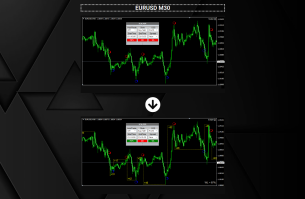

4. Chart Display

CORE ACC plots the following elements on the chart:

-

Trend Direction: Color-coded histogramr panel showing the current market bias (bullish or bearish).

-

Entry Signals: Upward or downward markers indicating confirmed entry opportunities.

All visual components update in real-time with each new tick, ensuring accurate and up-to-date information.

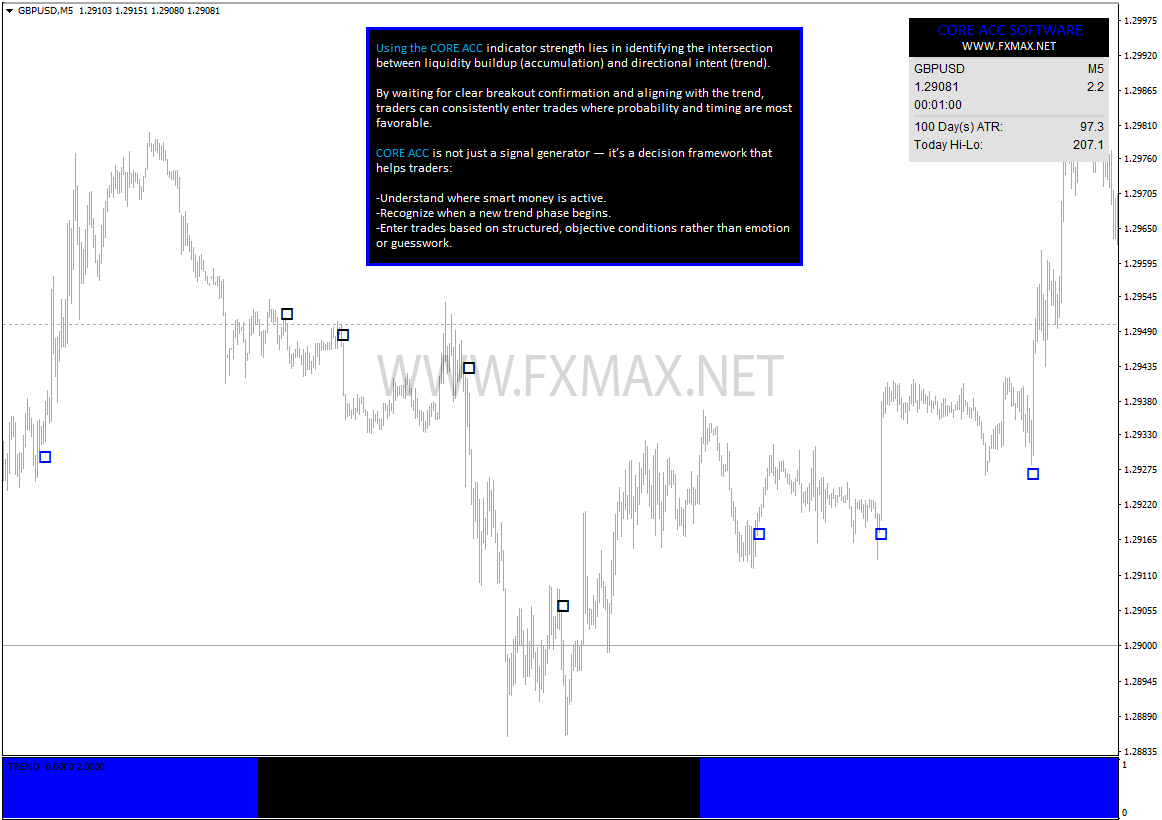

5. Recommended Usage

-

Timeframes: Works on all MT4 timeframes (M1–D1).

-

Markets: Compatible with Forex, indices, metals, and cryptocurrencies.

A. –

5