Magna PRO Volume Contracts

- Estimated Delivery : Up to 4 business days

- Free Shipping & Returns : On all orders over $200

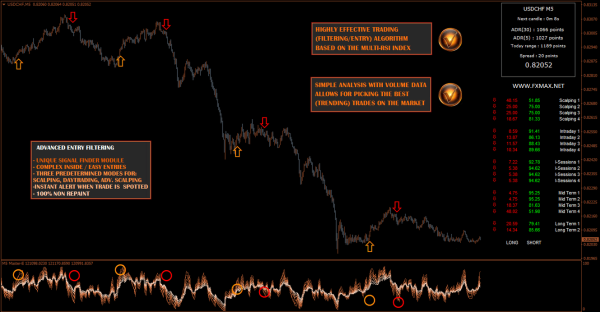

Magna PRO – Volume Contracts Software

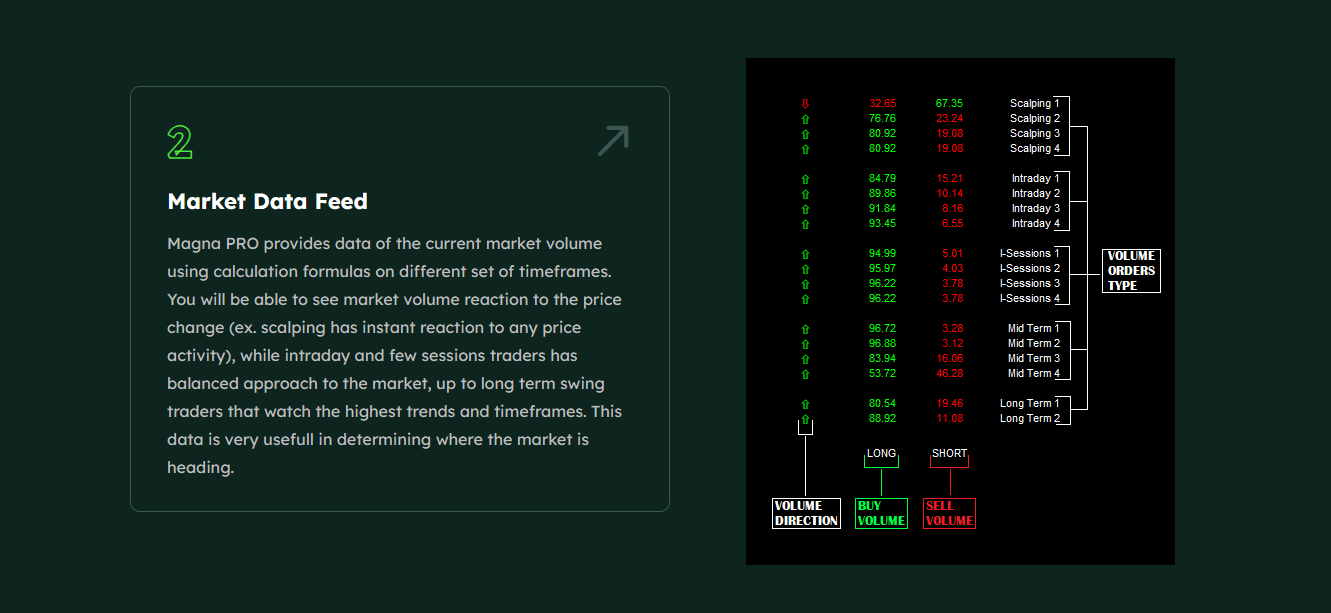

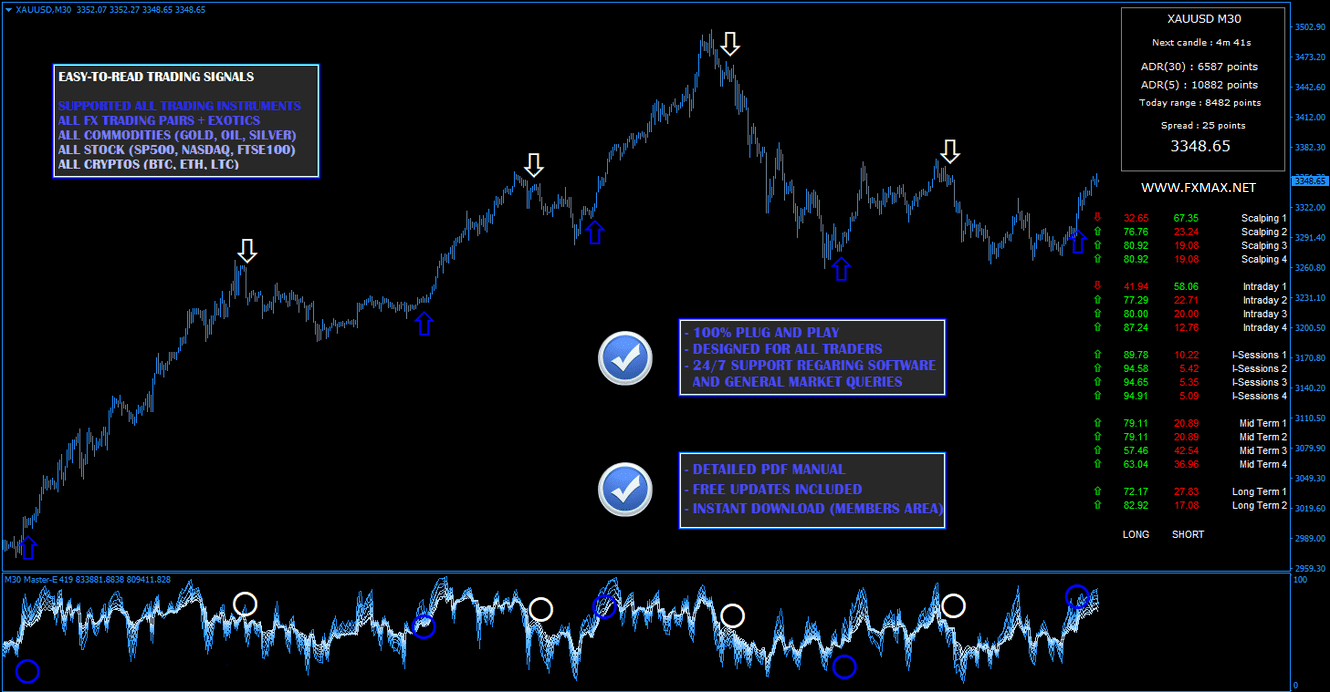

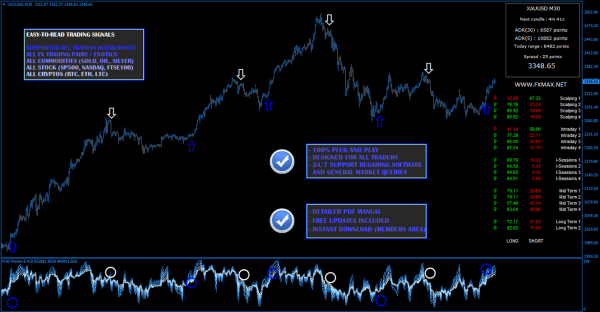

Magna PRO Volume Contracts Indicator is a powerful analytical tool designed to help traders better understand market activity by calculating trading volumes. Magna PRO displays the number of traded contracts in the market. Unlike standard MT4 tick volume, which only measures price changes, this indicator provides a more accurate representation of true market activity by focusing on actual contract volumes.

By identifying price zones with high levels of traded volume (“volume contacts”), traders can quickly spot key support and resistance areas, potential reversal points, and zones of strong institutional interest. This allows for more precise decision-making in entries, stop-loss placements, and profit targets.

Advantages

-

Provides deeper market insight compared to standard MT4 volume tools.

-

Adaptable for scalping, intraday, or long-term trading strategies.

-

Lightweight and optimized for performance on MT4.

-

Useful across multiple asset classes: Forex, commodities, indices, and futures-based instruments.

Key Features:

-

Calculates and visualizes volume contacts directly on MT4 charts.

- Helps identify accumulation and distribution zones.

-

Can be applied across multiple timeframes for scalping, swing trading, or long-term strategies.

-

Easy-to-use interface with customizable settings for volume calculation and display.

Why use it?

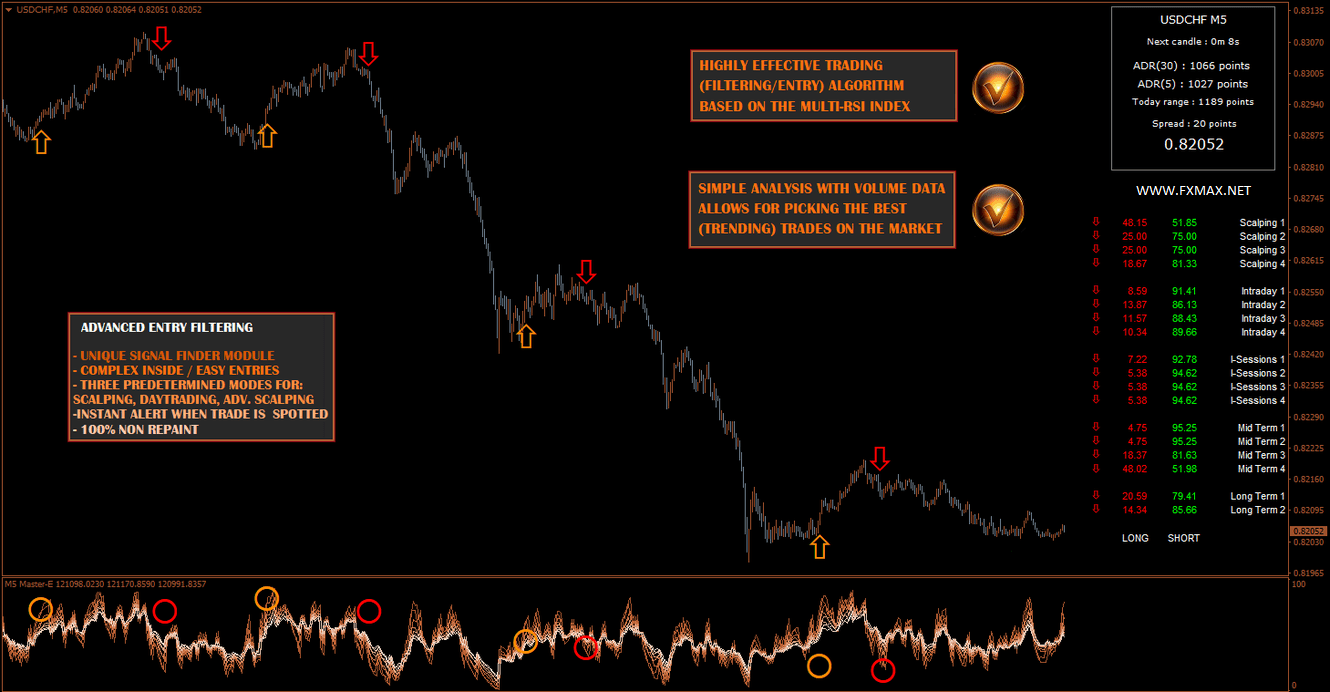

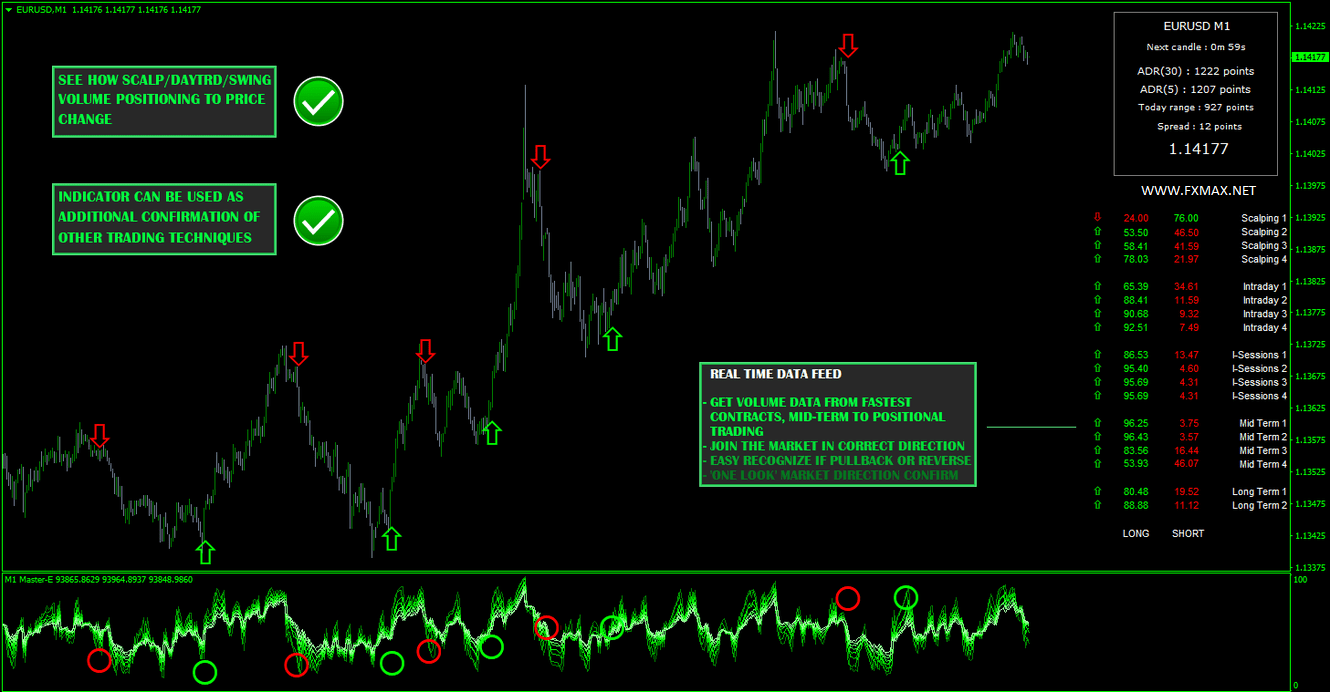

Trading volume is one of the most reliable confirmations of price movement. By focusing on where the majority of market participants are active, the Volume Contracts Indicator gives traders a deeper edge in understanding market structure and anticipating future price action.

Great addition to any trading method’

Magna PRO is designed not only as a standalone analysis instrument but also as a supportive tool that can enhance a variety of trading methods:

-

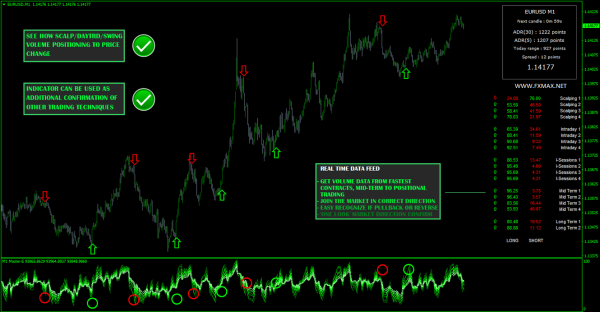

Trend Trading – confirm the strength of ongoing trends by analyzing contract volume behind price moves.

-

Breakout Strategies – identify genuine breakouts by detecting volume contract surges at key levels.

-

Range Trading – locate zones of accumulation and distribution where contracts cluster, helping to define reliable support and resistance.

-

Scalping – fine-tune entries by monitoring short-term spikes in contract activity.

-

Swing & Position Trading – track institutional activity across higher timeframes to align trades with market structure.

35 Keys Colorful Mixed Light Gaming Keyboard

35 Keys Colorful Mixed Light Gaming Keyboard

Johhny –

4 stars

Giving 4 stars, as there was not many signals today and yesterday. Overall very decent software, if the signal shows up it's pretty accurate.